Abu Dhabi Accord Signals Financial Upgrade

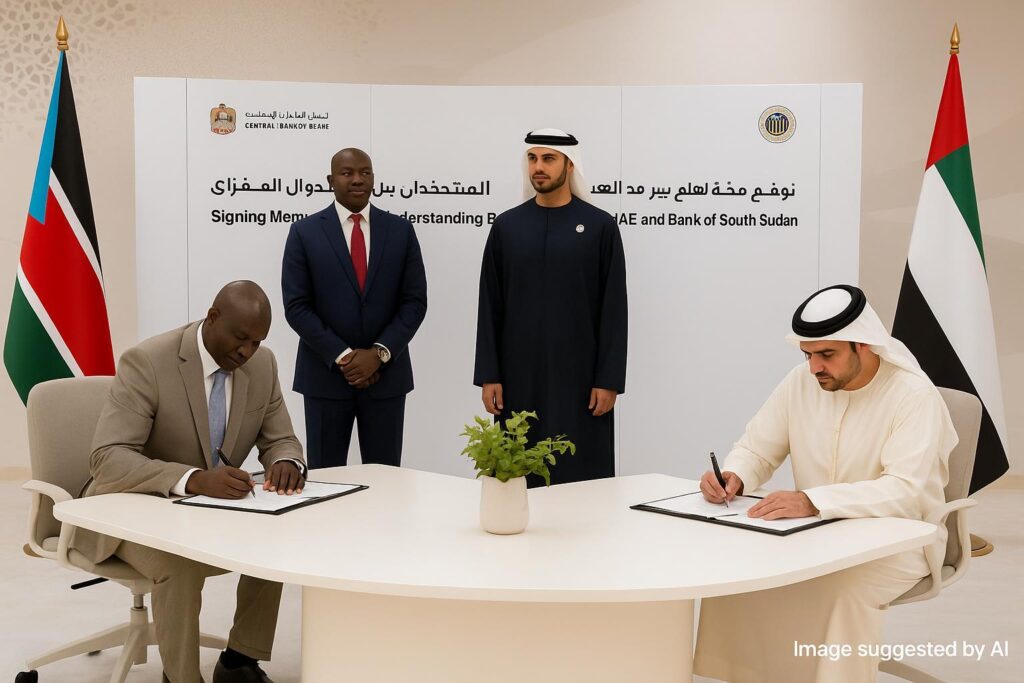

Flags of both nations fluttered over the UAE Central Bank as Governor Dr. Addis Ababa Othow and counterpart Saif Humaid Al Dhaheri inked the memorandum of understanding. Vice-President Dr. Benjamin Bol Mel called the signing “a strategic milestone for our young economy.”

Secure Payment Rails at the Core

The MoU centres on building advanced card-processing infrastructure resilient against fraud. Emirati engineers will share expertise on tokenisation, instant settlement, and cyber-defence, positioning South Sudan’s banks to clear transactions in real time.

Boosting Security Printing Capacity

Juba currently outsources most currency and document printing. Under the deal, technicians will train in Abu Dhabi’s state-of-the-art mint, with plans to install secure presses at the Bank of South Sudan. Officials expect cost savings and tighter control of anti-counterfeit features.

Training the Next Generation of Bankers

A scholarship pipeline will dispatch South Sudanese graduates to the Emirates Institute of Finance for courses in risk management and fintech regulation. “Skills transfer is as critical as hardware,” noted Dr. Othow, citing regional demand for qualified compliance officers.

Implications for Regional Integration

Faster, safer payments could knit South Sudan more tightly into East African trade corridors. Analysts suggest the system may interface with the Pan-African Payment and Settlement System, trimming dollar dependence and transaction costs (African Development Bank).

Looking Ahead

Implementation teams start work next quarter, with pilot card switches expected by year-end. Observers argue the agreement offers a pragmatic template for small economies seeking trusted partners to accelerate digital transformation without compromising monetary sovereignty.